charitable gift annuity rates

7 rows Immediate Payment Annuity current rates Age. If the CFMR is less than 06.

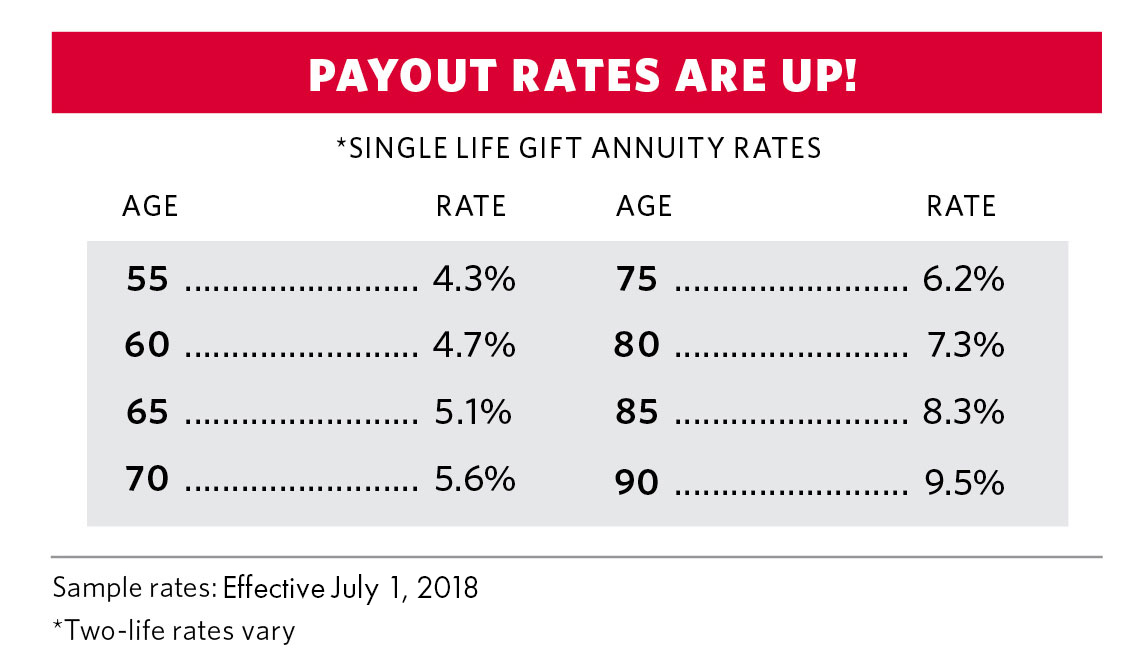

Charitable Gift Annuity Rates To Become More Attractive July 2018 Alabama West Florida United Methodist Foundation

125 rows For immediate gift annuities these rates will result in a charitable.

. 7 rows Many charities require a minimum 10000 to 25000 initial donation to fund the annuity. Ad Make A Charitable Donation Today. You can contribute cash or securities to Consumer Reports for a charitable gift annuity and in return receive fixed-rate lifetime annuity payments and a.

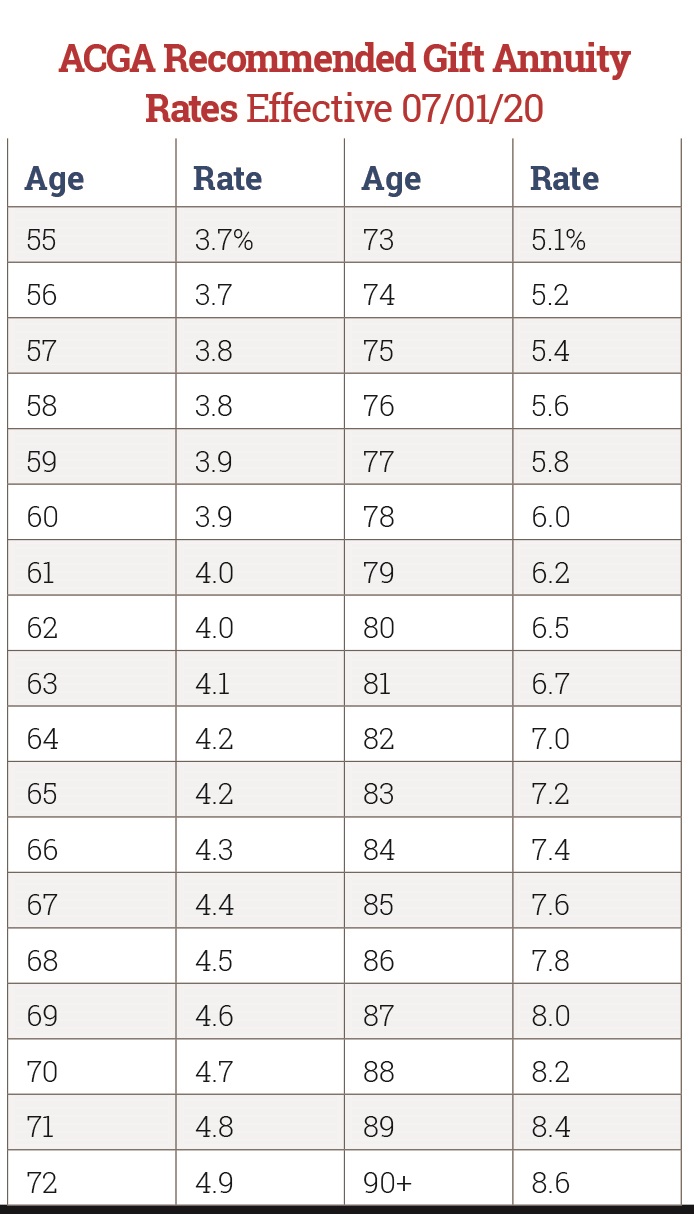

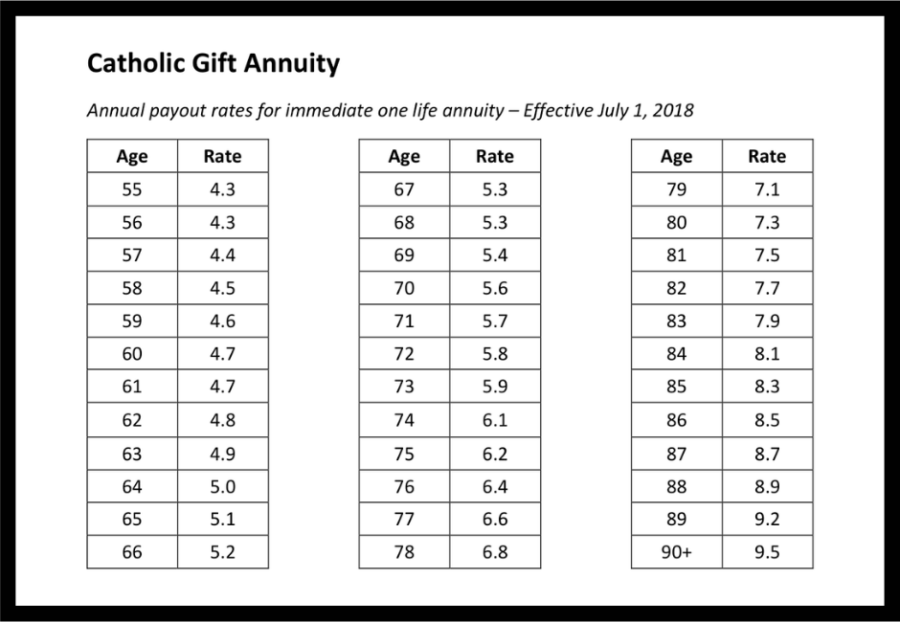

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. For illustrative purposes a 60-year-old who donates 10000 may receive a rate of 44 paying 440 annually while an 85-year-old will see a rate of 78 paying 780 annually for the same. A Companies Best Rates With A Free Customized Report.

Ad Annuities are often complex retirement investment products. Learn some startling facts. Ad Helping donors unlock their assets for charitable good since 1999.

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Create a plan that fits your financial situation and maximizes your philanthropy. Ad Compare Annuities Online.

The minimum required gift for a charitable gift annuity is 10000. Ad Get Guaranteed Quotes From Over 25 Top Rated Companies. In exchange the charity assumes a legal obligation.

Charitable Gift Annuity Rates Rates Effective as of January 1 2012 SINGLE LIFE AGE RATE AGE RATE AGE RATE AGE RATE 55 56 57 58 59 60 61 62 63 40 41 41 42 43 44 44. Help Lift Families Out Of Poverty. Ad Annuities are often complex retirement investment products.

Online provider of income annuities fixed annuities and the Personal Pension. Learn some startling facts. Ad The best selection of fixed rate annuity rates.

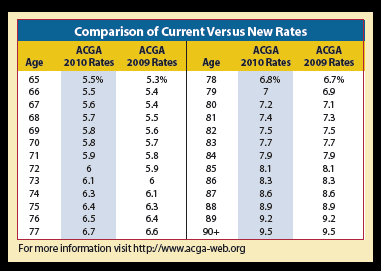

ACGA Report on Progress in Resolving Gift Annuity Rate Challenges in New York State. The American Council on Gift Annuities ACGA is pleased to share our progress in working with regulators in New York State regarding maximum allowable charitable gift annuity payout. The rates for charitable gift annuities are often lower than those offered by insurance.

Charitable gift planning has lost a champion. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. The American Council on Gift.

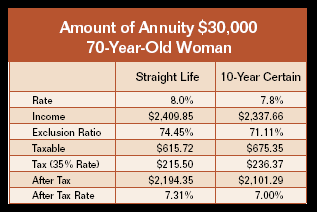

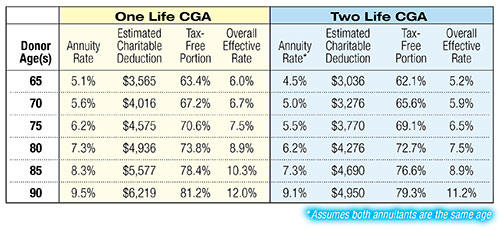

American Council on Gift Annuities a national associa-tion of charities. Two Lives Joint Survivor Younger Age Older Age Rate. Age Rate 65 57 80 76 70 61 85 89 75 67 90 105 For example if a 65-year-old individual makes a contribution.

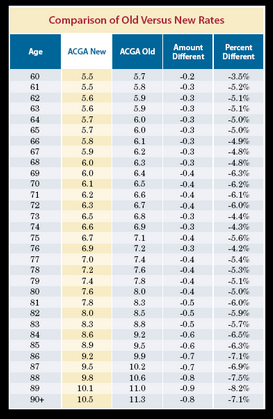

For immediate gift annuities these rates will result in a charitable deduction of more than 10 if the CFMR is 06 or higher whatever the payment frequency. SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Acga Announces New Suggested Charitable Gift Annuity Rates Sharpe Group

Are Gifts Annuities Beyond Compare Understanding Commercial Versus Charitable Gift Annuities Sharpe Group

Rising Rates On Charitable Gift Annuities The Institute For Creation Research

Charitable Gift Annuity Rates January 2020 Alabama West Florida United Methodist Foundation

Acga Lowers Gift Annuity Rates Sharpe Group

Gift Calculator South Carolina Catholic

Gifts That Provide Income Giving To Mit

Spencer Sacred Heart Charitable Gift Annuities Spencer Ia

Special Update New York Charitable Gift Annuity Rates

Charitable Gift Annuities Mission To The World

Free Download How To Let Your Donors Know About The New Charitable Gift Annuity Rates

Compelling Stories Market Charitable Gift Annuities Most Effectively

Charitable Gift Annuity Rate Increases Texas A M Foundation

Annuities The Catholic Foundation

Acga Charitable Gift Annuity Rates

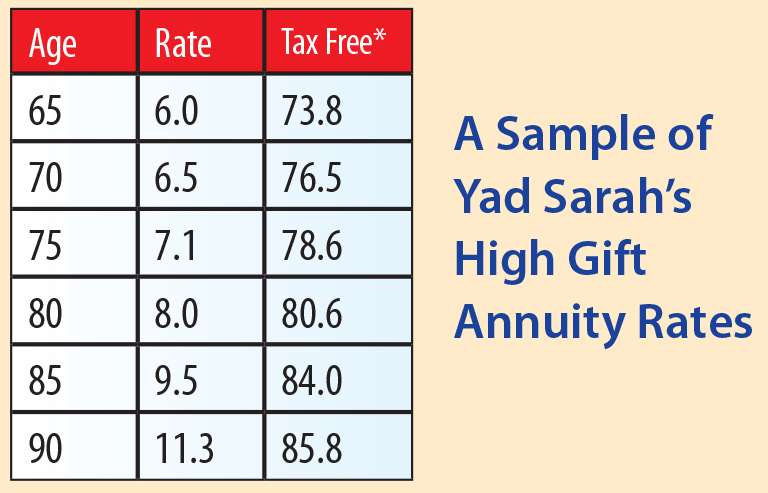

Friends Of Yad Sarah Friends Of Yad Sarah

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home